Ventripoint Diagnostics Ltd. Corporate Update Conference Call

Transcript

(This is an A.I. generated transcript. Please check accuracy against actually recording when required)

Date: Time: Speakers:

December 9, 2024 12:00 PM EST

Hugh MacNaught

President, Chief Executive Officer

Good afternoon. I wish to thank everyone for joining Ventripoint’s Q3 2023 Corporate Update. The purpose of this meeting is to provide an update on the Company’s progress since the last update earlier this year. If you have not already done so please put your microphones on mute for this segment of the call.

Please note the Ventripoint disclaimer regarding forward forward-looking statements.

The 2024 third quarter financial report and MD&A were completed and filed at the end of November and are available on SEDAR.

The Company recorded sales of $64,507 and a net loss totaling $1,251,079 for the three months ended September 30, 2024. This compares with sales of $nil and a net loss of $1,174,285 for the corresponding period in 2023. The increase in net loss was principally because:

- For the three months ended September 30, 2024, general and administrative expenses were $709,886 compared to $572,592 for the three months ended September 30, 2023. The increase in general and administrative was primarily due to increases in share- based compensation and travel costs.

- For the three months ended September 30, 2024, research and development expenses were $270,516, compared to $408,586 for the three months ended September 30, 2023. The decrease in research and development was primarily due to decreases in salaries, consulting fees, and VMS scraps and research & demo units.

- For the three months ended September 30, 2024, sales and marketing expenses were $278,115, compared to $198,877 for the three months ended September 30, 2023. The increase in sales and marketing was primarily due to increases in share-based compensation and advisory services.

- For the three months ended September 30, 2024, finance cost was $64,410, compared to $4,062 for the three months ended September 30, 2023. The increase in finance cost was primarily due to an increase in accretion expense and decrease in interest income.

For the nine month period ending September 30, 2024, compared with nine months ended September 30, 2023 the Company recorded sales of $95,172 and a net loss totaling $3,858,523. This compares with sales of $7,781 and a net loss of $3,634,823 for the nine month period ending September 30, 2023. The change in net loss was principally because:

- General and administrative expenses were $2,002,304, compared to $2,116,675 for the nine months ended September 30, 2023. The decrease in G&A expense was primarily due to decreases in salaries, professional fees, travel costs, and share-based compensation.

- Research and development expenses were $777,424, compared to $872,718 for the nine months ended September 30, 2023. The decrease in research and development was primarily due to decreases in salaries and consulting fees.

- Sales and marketing expenses were $1,065,796, compared to $701,134 for the nine months ended September 30, 2023. The increase in sales and marketing was primarily due to increases in salaries, travel costs, and share-based compensation.

- Finance costs were $103,929, compared to finance income of $7,910 for the nine months ended September 30, 2023. The increase in finance cost was primarily due to an increase in accretion expense and decrease in interest income.

- Other income was $nil, compared to $64,594 for the nine months ended September 30, 2023. The decrease in other income was due to contribution from the National Research Council of Canada Industrial Research Assistance Program (NRC IRAP) received in the prior year. No amounts received during the current year.

The Company recorded deferred sales for the nine months ended September 30, 2024 of $76,772. This will be recorded as revenue when the clients accept the units.

Cash used in operating activities was $2,665,385 for the nine months ended September 30, 2024, compared to $2,812,122 for the nine months ended September 30, 2023.

Cash provided by financing activities was $1,492,958 for the nine months ended September 30, 2024, compared to cash used in financing activities of $72,958 for the nine months ended September 30, 2023. Insiders, employees and contractors participated in the convertible debenture financing as well as purchasing common shares on the open market. A subsequent LIFE offering was closed this quarter, with subscription largely comprised of insiders, employees and contractors. We have been able to maintain team structure and continue to pursue key objectives.

The Company is continuing to raise capital to fund its general and administrative expenditures plus its development and commercialization activities. Management will reassess planned expenditures based on working capital available, the scope of work required to advance towards defined milestones and the overall condition of the financial markets.

I will now turn my comments to the year to date. Some of these comments will repeat what was previously communicated.

Throughout the year there were extensive interactions with the board of directors, the Ventripoint team, distributors and customers. All remain committed to Ventripoint and VMS+.

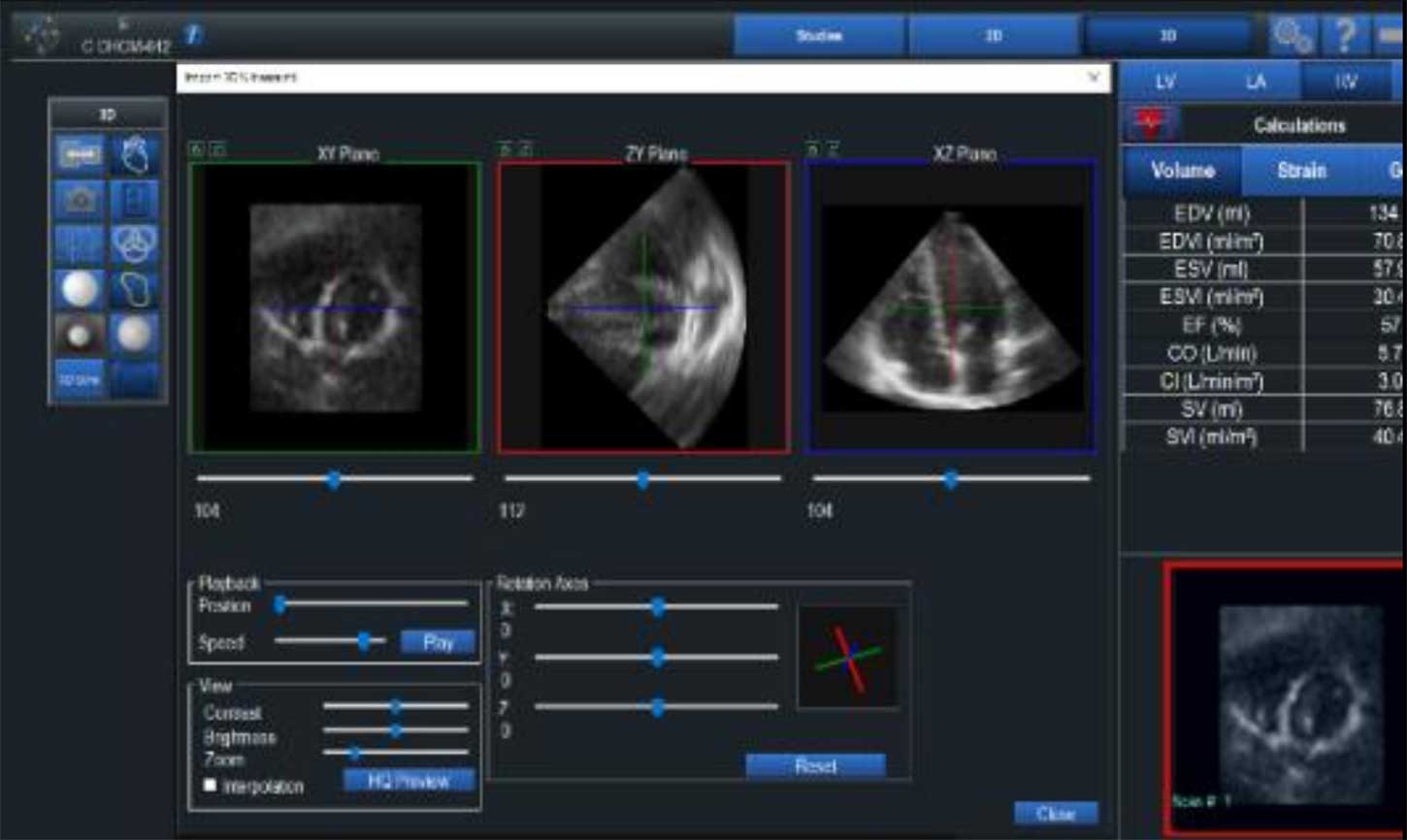

VMS+ v3.2 was released for sale at the end of the first quarter. A key feature is a hardware redesign that eliminated the use of magnets in the sensors. The benefit of this is a streamlined calibration process that saves time and enables smoother integration into clinical workflow. During the past two quarters we have focused on the manufacturing process for the sensors and are now able to produce these in quantities that address sales forecasts. Our team is in the process of upgrading customer sites and initial feedback has been very positive. For an example of this please visit our website and view the video clip of a customer testimonial from the annual Take Heart conference.

The second system sold to Duke University has been installed, training provided and the unit is now in use.

In early May we submitted VMS+ v4 to FDA for 510(k) clearance using an expedited process and were advised to resubmit under the standard process due to the novelty of certain product features. This was achieved by the end of that month and we received the review in August. To address several of the questions we elected to engage an external company to conduct cybersecurity testing, and contracted a regulatory consultancy to assist with questions related to AI. Our written follow up is largely complete and we anticipate receiving the additional information within the next 2-3 weeks, following which we will submit the package to FDA. This has taken longer than was originally forecast but we believe that completeness of information is important to the success of the submission.

In May we announced the recruitment of a senior marketing executive, Matt Dobson, to provide leadership in defining the marketing function and evolving product management focus towards being market and insight driven. The underlying rationale was to begin evolving the corporate culture to addressing unmet clinical needs and ensuring an optimal product-market fit. Since joining the team Matt has worked extensively with internal and external stakeholders to develop deeper insights into customer need and customer experience. He was assisted by

an MBA intern on a four month term who focused on characterising the market and competitive environment.

We continue to work on developing insights and are getting a better sense of how VMS+ integrates into clinical workflow, and how the advancements provided by Version 3.2 enable better integration. Concurrently we are also getting clarity on accelerating the transition of the use of the product from clinical research to routine practice. As we evolve from promoting a technology push to exploiting a market pull we are developing a stronger understanding of how to progress from raising awareness of VMS+ to creating excitement in clinicians and patients about the potential of our products. We are continuing to identify where the use of VMS+ has progressed to routine clinical use and adoption, both in terms of procedure volume and user experience.

In June we announced the renewal of our agreement with Ascend Cardiovascular and expansion of scope to include 2D echo. We are in the process of defining the 2D echo project and commercialization plan with the intent of introducing an integrated offering in mid 2025. We anticipate sharing additional information regarding this prior to year end.

Our assessment and update of the commercialisation strategy was largely complete by early Q3 and since then we have continued to work with our commercial team and distribution partners to develop deeper insights into the sales model and process with the objective of removing friction from the sales process. We engaged a consultancy to guide us through the implementation of a CRM, and are now positioned to begin integrating it with those of our distributors to provide a more seamless overview of the sales funnel. The CRM will also support better forecasting and resource allocation.

In Q3 we received a Medical Device License from Health Canada which enables us to sell v4 within Canada. Shortly afterwards we noted receipt of CE-mark registration which enables marketing of VMS v4 within the EU, the UK and a number of other countries.

Mid-Q3 we engaged a UK-based sales executive to provide leadership in accelerating the pace and scale of sales in the UK. He is working closely with our UK distributor Cardiologic and has identified alternative sources of funding which may be available to certain prospective customers. We are currently working to close the sale of several units in the UK, and had hoped to have these in hand by now. Our UK team understands the importance of securing these orders and is working diligently to that end. During the past six weeks we have identified a number of good prospects for 2025.

Similarly, we worked with AngioPro to conduct demonstrations at a number of sites in Europe of which it is believed that two sites will commit to purchasing three units in the near future. As with the UK team we are working to close these sales as soon as possible. Within the AngioPro pipeline there are another eighteen demos planned for early 2025 that will be scheduled when Ventripoint is better able to commit personnel and travel expenses. Beyond these there are several dozen more prospects in the process of being qualified and progressing to demos.

Our assessment of commercial operations in the US has resulted in an updated approach for 2025. This program is intended to accelerate the adoption of VMS+ solutions, and will provide targeted support to healthcare providers, hospitals, and clinics across the U.S. The new program focuses on:

Dedicated Sales Support: Our direct sales team will engage directly with healthcare providers to validate the sales model and process prior to the company engaging specialty distributors. The team will work with customers to guide them through the implementation and integration of VMS+.

Training and Education: The company is developing training modules and support resources for clinicians to fully leverage VMS+ for optimal patient care.

Flexible Pricing and Financing Options: Upon FDA clearance of VMS+ v4 the list price will be increased to properly reflect the enhanced value of our offering. Concurrently, customers will be provided with a subscription option that will enable them to work within their operating budgets and will make VMS+ accessible to healthcare providers of all sizes. It also benefits Ventripoint by creating a recurring revenue stream.

Reference Centre Program: Ventripoint will invite one or more U.S. based customers to become partners within its Reference Centre Program, which is focused on addressing clinical needs with new capabilities and ensuring seamless integration of these into clinical workflows. In previous years similar programs were announced. This one differs in that we are seeking collaborative and interactive relationships, and not merely sponsoring service agreements. By actively managing these relationships they will serve as anchors within our ecosystem.

Partnership Opportunities: Ventripoint will expand on its partnerships with the Ollie Hinkle Foundation and Ascend Cardiovascular to develop relationships with other foundations, technology and service providers dedicated to advancing cardiac care.

We remain very focused on North American and European and UK markets, and are assessing models for ROW geographies. We are working with a member of an Asian family office to assess manufacturing, distribution and financing opportunities in India and South Asia.

We have also been approached by parties interested in distribution rights for China and the MENA region.

This brings us to our outlook for 2025.

We are now positioned with a significantly more capable and refined product that is better suited for routine clinical use. We have a clearer understanding of the process of

commercializing the technology and product and what is required to reduce and remove friction within the sales process. We are in the process of completing our plans and forecasts and I am comfortable sharing that there is a clear focus and commitment to sales with the intent of positioning for geometric growth in the coming years.

The ability to execute on these plans is of course heavily dependent on the availability of capital. Throughout 2024 through the commitment and resolve of insiders, team members and a number of dedicated shareholders we have demonstrated the ability to maintain operations despite an extremely challenging financial environment. We are currently working to raise a $1M bridge round through a convertible debenture offering which will position Ventripoint to work with family offices and private equity firms to secure the growth capital necessary to support achievement of our goals.

Ventripoint is a pioneer in the application AI to echo. We are continuing to show our leadership by providing accurate, consistent and reproducible results. Our image catalogue and reconstruction techniques are unique, can salvage poor quality images, and are able to address the challenges related to the right ventricle, which no other vendor can do. Our development team has clearly made strides in improving the form factor and useability of the product, while reducing the complexity of the hardware and cost of goods. Our technology and product roadmap includes ambitious objectives for the next three years and clinicians will develop a growing confidence and trust in VMS+. Ventripoint has made significant strides in 2024 and will continue to do so in 2025.

I wish to thank you for your interest and ongoing support, and trust that a number of you will participate in the bridge round. Thank you for participating on today’s call. For those with additional or ongoing questions please feel free to reach out, either to myself or through the contact information listed on our website. Have a pleasant day.